Cheques are one of the most common ways of transferring money between people and businesses.

A cheque is a document or a piece of paper that orders the bank to pay the person who bears (holds) the cheque or the person to whom the cheque is addressed. Here it could be a business or a company, instead of a person.

There are two ways of writing cheques (for the person who is paying the money):

- A/C Payee cheque - where money can be deposited in the account of the payee (the person to whom payment has to be made, the name mentioned on the cheque) and cannot be encashed. The two parallel lines on the top left of the cheque mean it is an a/c payee cheque

- Bearer cheque - this means anyone bearing or presenting the cheque on the bank counter is to be paid the amount mentioned on the cheque.

There are two ways of receiving the payment/money if you hold or have received the cheque:

- By encashing it - where you recieve cash immediately when you present the cheque in the bank, or

- By depositing it - where the money gets added (credited) to your bank account. This process usually takes 2-3 days, and is called the cheque getting “cleared”

Now that we know the different ways to pay and receive from a cheque, let us learn how to fill up a cheque,

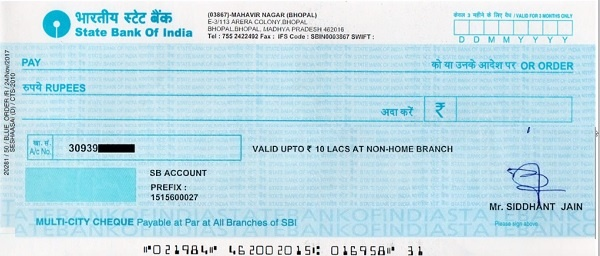

- Fill in the date, in the blocks on the top right side. Write one digit in each block.

- If you are writing an A/C Payee cheque, draw two lines at the top left; if its a bearer cheque, proceed to write the name.

- Write the name of the person you want to pay, make sure you write their name, surname, and the middle name if they use any. Keep in mind to avoid any cancellations or overwriting. If it is an A/C payee cheque, strike out “or bearer” written towards the right side; if it’s a bearer cheque, do not cancel out.

- Write the amount to be paid in words. For example, if you are supposed to pay ₹1000, write - One Thousand Only; if you are paying ₹2250, write - Two Thousand Two Fifty Only. It is important to mention “Only” after the amount to avoid any fraud ( anyone can write any amount after it)

- Fill the amount in numbers, and include /- after the amount again to avoid any fraud from happening.

- Sign at the bottom, above your name or where it is written “Please Sign Above.”

- Look carefully for any mistakes or if you have missed out on any part.

Some basic tips to keep in mind while writing a cheque:

- Be clear about the details like name and amount to be paid beforehand, to avoid any cancellation or overwriting. If the bank sees any overwriting, they may not clear the cheque for security reasons. This is called the cheque getting bounced, which is a criminal offence. So take all the necessary measures to avoid it.

- If you think your signature is not clear or it may not match, you can sign again next to or above your original signature. Again, do not overwrite or cancel your sign. Just sign again.

- If you are paying to any institution or body where they will receive many cheques from different people (for example, for payment of fees) write your details like name, mobile number and any identity number on the reverse side of the cheque. This will help the institution reach out to you in case there is any problem.

- Fill in the first page/particulars of the the cheque book with the details of your payments. This is for your future reference and to keep a track of all the cheques that were used and for what purposes.

This was it from our side on how cheques work in the real world. We hope you are taking back home some useful information on cheques and how they work!